Table Of Content

- Inflation remained stubbornly high before finally falling

- Top Housing Markets for 2023

- Residential Real Estate Stats: Existing, New and Pending Home Sales

- Ready to Sell a Los Angeles Property? Choose FlipSplit.

- Prediction #12: Buyers’ agent commissions will rise slightly as fewer agents broker fewer deals at lower prices

- CMC BUYERS LOUNGE

Here’s a closer look at the direction of the housing market as the year comes to a close. The pace of sales has slowed considerably from the days when most sellers made deals in a week or less. Olsen sees the average time on the market doubling from 11 days in 2022 to 22 days next year, which will allow the housing supply to build up. While experts are in agreement that mortgage rates are likely to fall, there is a bigger disparity when it comes to home prices. Our experts’ forecasts range from prices falling 4% to a price increase of more than 5%.

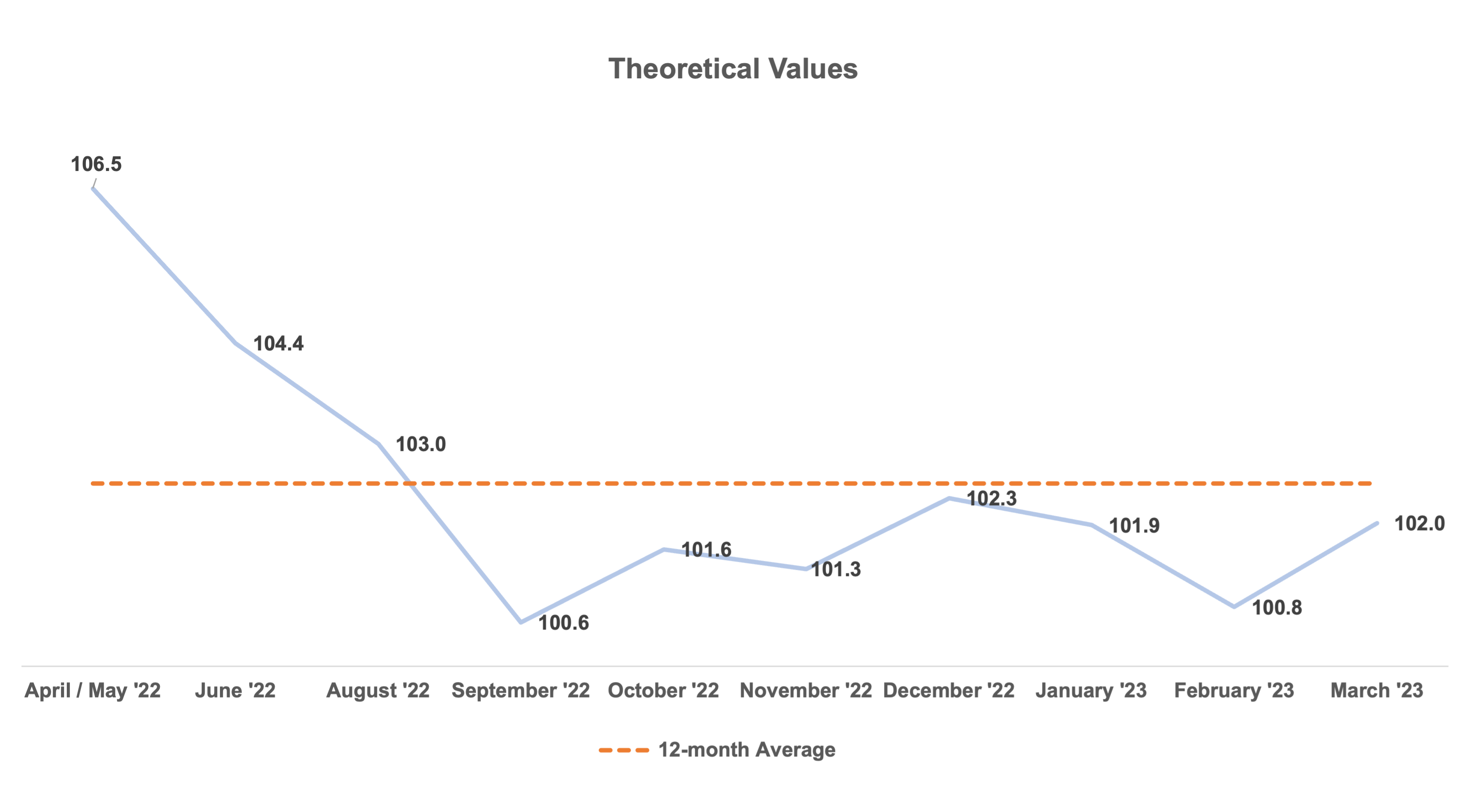

Inflation remained stubbornly high before finally falling

As these decreases work their way into inflation readings, Olsen believes the Fed will go lighter in its short-term rate hikes moving forward. Our experts believe that mortgage rates will likely remain relatively high during the first few months of the year but then edge lower and stabilize, with rates falling below 6% by the end of the year. Lawrence Yun, chief economist at NAR, for example, thinks the 30-year mortgage rate will end 2023 at around 5.5%. Inflation will continue its gradual decline over the next 18 months, with the CPI registering 2.6% in 2024, down from 3.9% in 2023. As such, the average 30-year, fixed mortgage interest rate will decline from 6.7 percent in 2023 but remain elevated at 6.0 percent in 2024. While the outright share of cash-buying is slightly lower in the top markets, it has been growing faster, on average, than in the top 100 markets.

Top Housing Markets for 2023

Nationwide, luxury home prices grew nearly three times faster than non-luxury prices but dropped in expensive metros as people migrated to more affordable areas. The dramatic drop in new listings was primarily due to skyrocketing mortgage rates, keeping buyers and sellers on the sidelines. We expect economic growth to modestly slow from the above 2023 trend growth to the longer-term trend in 2024. The pace of growth of consumption spending may decrease from the levels we saw this year and we expect hiring to cool off, leading to a modest uptick in unemployment. But the progress on inflation will allow the Federal Reserve to continue to pause or start to cut rates. If you’re wading into the real estate market this winter, it’s important to do your research.

Residential Real Estate Stats: Existing, New and Pending Home Sales

These trends are reflected in the cross-market demand data for the Top 10 markets, where almost half of shoppers are seeking homes from other states. In Hartford, CT, homebuyers from New York, Boston, and Washington, DC, were leading the wave of out-of-state views in the third quarter of 2022. With a median price of $372,000 in November 2022, Hartford’s homes offered a significant value proposition, compared not only to the high price of houses in New York City ($669,000), but also the national median ($415,750). Ranking is based on the combined yearly percentage growth in both home sales and prices expected in 2023 among the top 100 largest markets in the country per Realtor.com’s metro level housing forecast. The hot pandemic-era housing market pushed the typical U.S. buyers’ agent commission down to 2.63% of the home’s sale price in 2022, its lowest level since at least 2012.

This short-supply was the result of over a decade of underbuilding new construction, coupled with Americans living longer in their homes. This was also evident in the for-sale market where the number of homes available for sale reached a record low early in 2022. With fewer properties to choose from and favorable borrowing conditions, prices skyrocketed to a new high in June 2022.

Conversely, Exhibit 4 also shows Northeastern urban areas outside of the largest cities have been leading the way in terms of annual house price appreciation, especially in the last couple of months. This new trend likely reflects the fact that these markets remain affordable and have not previously had substantial increases in home prices. High prices and high demand are great, but keep in mind that not everything is rosy, even for sellers. The amount of time homes are taking to sell is inching upward, with September homes spending around 21 days on the market before going into contract, and high mortgage rates are keeping many potential buyers on the sidelines.

Since the first quarter of 2012 (when the economy was just starting to recover from The Great Recession), the median home value in LA has increased approximately 131.5%. For the majority of that time, the increase was due to an expanding economy and improving consumer sentiment. The Los Angeles housing market is at the forefront of both a national and global recovery.

CMC BUYERS LOUNGE

Thus, the home sales market in 2024 will look similar to 2023, characterized by low transaction volume and a severe lack of inventory. However, due to the still tight supply of for sale inventory, we forecast house prices to increase 6.3% in 2023 and 2.7% in 2024 nationally. The move toward affordability will continue in 2023, as high prices and mortgage rates drive buyers to find lower-priced homes.

National Housing & Economic Forecast 2023 Mid-year Update: Despite Easing Home Prices, Costs Remain High

We expect U.S. asking rents to post a small year-over-year decline by mid-2023, with drops coming much sooner in some metros. Some large landlords are likely to offer concessions, such as a free month’s rent or free parking, before dropping asking rents. Housing markets in relatively affordable Midwest and East Coast metros, especially in the Chicago area and parts of Connecticut and upstate New York, will hold up relatively well, even as the U.S. market cools. Those areas tend to be more stable than expensive coastal areas and they didn’t heat up as much during the pandemic homebuying frenzy.

2024 Q1 Housing Market Trends: What To Expect - Bankrate.com

2024 Q1 Housing Market Trends: What To Expect.

Posted: Tue, 19 Mar 2024 07:00:00 GMT [source]

In the year ahead, the housing market may be slow to start, with home prices, rents, inventory and interest rates not moving much at all, according to economists, analysts and real estate brokers. The increasing frequency and intensity of natural disasters has prompted some insurers to stop providing coverage in risky areas altogether, and others to raise rates for flood and fire insurance. Florida property insurance premiums increased 33% year over year in 2022, and they’re expected to rise more after Hurricane Ian wreaked havoc on parts of coastal Florida in September. Americans with FEMA flood insurance–especially those in Florida, Mississippi and Texas–are also starting to see their flood insurance premiums increase after the government agency overhauled its pricing. In California, many private insurers have stopped covering high-fire-risk homes, which means many homeowners and buyers must use a last-resort plan and spend two to three times more on premiums.

Existing-home sales came to life in February, shooting up 9.5% from the month before, according to the latest data from the NAR. Gibbs says that if sellers don’t offer compensation, many buyers who can’t otherwise afford to pay a broker will choose to go unrepresented. “Better that rate reductions happen at a metered pace, incrementally improving buyer opportunities over a stretch of time, rather than all at once,” Gumbinger says. The cost of construction and labor, and delays due to permitting and regulations, continue to impede ... New home and multifamily construction projects slated for delivery in 2024 and 2025 are expected to ... However, the declines shrunk from a low of -37.5% in January to just -4.8% in November, showing a promising upward trend leading into 2024.

Redfin economists say this is likely to be the slowest sales year since the Great Recession as persistently high mortgage rates and low inventory spook buyers. “Hot” was the most common word used to describe the majority of real estate markets as recently as the first few months of 2022. That will no longer be the case going into 2023, as different metros will start to see differences in demand. Instead, there are signs that rates have room to fall from their current level. Skylar Olsen, chief economist at listing site Zillow, points to falling rent prices, a major component of the Consumer Price Index, as a reason for optimism around lower rates.

No comments:

Post a Comment